Simon Madziar

Simon Madziar

Investing in real estate can be a lucrative venture, but are you fully capitalising on the financial benefits that your property holds? One often-overlooked financial tool that can significantly impact your investment journey is a depreciation schedule for rental properties. A depreciation schedule is a detailed report prepared by a qualified property tax accountant that outlines the various tax depreciation deductions available for a specific investment property, also known as a tax depreciation report. This report is essential for property owners, as it provides crucial information for tax purposes and can be completed with the help of a property manager. By understanding and harnessing the potential of a property tax depreciation schedule, property investors can maximise their tax deductions, unlock hidden value within their residential investment properties, and make a tangible difference to their bottom line. While it may sound complex, a tax depreciation schedule is an essential tool for property investors, providing them with the opportunity to optimise their cash flow, increase their returns, and enhance their overall financial position over the lifetime of a property. A depreciation schedule for rental property typically includes property details, purchase price, depreciation method used, useful life of assets, depreciation rates, and the annual depreciation amount. It's a detailed plan outlining how property value decreases over time for tax purposes. In this essential guide, we will explore the basics of depreciation schedules for rental properties, why they are important for property investors, the different types of depreciation relevant to rental properties, the benefits of having a depreciation schedule, how to create one, and how to maximise depreciation claims. We will also delve into real-life case studies, legislative considerations, and compliance requirements. So let's dive in and uncover the secrets of a depreciation schedule for rental properties. A depreciation schedule for rental property is a detailed report that outlines the various tax depreciation deductions available for an investment property. It is prepared by a qualified professional quantity surveyor and provides property owners with a breakdown of the depreciable components of their property and the corresponding depreciation deductions that can be claimed on their annual tax return. This financial tool is essential for property investors as it allows them to maximise their tax deductions, increase their cash flow, and make informed financial decisions. Depreciation is the decline in the value of assets over time due to wear and tear or obsolescence. In the context of rental properties, depreciation refers to the decrease in value of the property's structure and its assets. There are two types of depreciation relevant to rental properties: capital works depreciation and plant and equipment depreciation. Capital works depreciation, also known as building depreciation, refers to the depreciation deductions claimed on the building's structure and any permanent fixtures. This includes components such as walls, floors, roofs, windows and doors, and plumbing and electrical systems. The depreciation deductions for capital works are calculated based on the effective life of the building and can be claimed using either the prime cost method or the diminishing value method. Plant and equipment depreciation, on the other hand, encompasses removable assets like appliances, carpets, blinds, and air conditioning units. These assets have a shorter effective life compared to the building structure and can be claimed using the diminishing value method. The depreciation deductions for plant and equipment are calculated based on the cost of the asset, its effective life, and its depreciation rate. Understanding the basics of depreciation is crucial for property investors as it allows them to accurately identify and claim the depreciation deductions available for their rental properties. By doing so, they can maximise their tax benefits and improve their overall financial position. Depreciation schedules play a crucial role in real estate investment, especially for property investors. They provide a clear breakdown of the depreciable components of an investment property and the associated depreciation deductions that can be claimed. By having a depreciation schedule, property investors can maximise their tax deductions, increase their cash flow, and make informed financial decisions. One of the key benefits of having a depreciation schedule is the ability to increase tax deductions. By accurately claiming depreciation expenses on their annual tax return, property investors can reduce their taxable income, resulting in significant tax savings. These tax savings can then be reinvested in property maintenance, mortgage repayments, or further property investments, ultimately enhancing their overall financial position. Another important aspect of depreciation schedules is the impact they have on cash flow. The tax savings generated from depreciation deductions can positively influence a property investor's cash flow, providing them with additional funds that can be used for various purposes. This improved cash flow can further support property maintenance, mortgage repayments, or even fund future property investments, ultimately enhancing the investor's financial stability. Overall, depreciation schedules are essential for property investors as they allow them to optimise their tax benefits, increase their cash flow, and make informed financial decisions. By having a clear understanding of the depreciation deductions available for their rental properties, property investors can make the most of their investment and achieve their financial goals. Capital works deductions are a crucial aspect of depreciation for rental properties. These deductions refer to the depreciation claimed on the building's structure and any permanent fixtures. It includes components such as walls, floors, roofs, windows and doors, and plumbing and electrical systems. To calculate capital works deductions, property owners need to consider the construction costs of the building. This includes the cost of materials, labor, and any associated expenses incurred during the construction process. The effective life of the building, typically 40 years, is also taken into account when calculating the depreciation deductions. A depreciation schedule prepared by a qualified quantity surveyor will provide property owners with a detailed breakdown of the capital works deductions available for their rental property. This includes the projected annual depreciation rate for each component and the corresponding claim deductions. By accurately claiming capital works deductions, property owners can maximise their tax benefits and improve their overall financial position. These deductions can significantly reduce taxable income, resulting in considerable tax savings for property investors. The property tax depreciation schedule also includes plant and equipment depreciation, which encompasses removable assets like appliances, carpets, blinds, and air conditioning units. These assets have a limited effective life and are subject to wear and tear, making them eligible for tax deductions. The depreciation of plant and equipment assets is generally calculated using the diminishing value method. This method allows for higher deductions in the earlier years of ownership, reflecting the faster rate of depreciation during that time. The effective life of each asset is used to determine the depreciation rate, and the deductions are calculated accordingly. It is important for property owners to carefully identify and document the depreciable assets within their investment property to ensure accurate depreciation claims. The property tax depreciation schedule provides a breakdown of these assets, their estimated effective lives, and the corresponding depreciation deductions that can be claimed each year. By including both capital works and plant and equipment depreciation in the schedule, property owners can maximise their overall tax deductions and optimise the financial benefits of their investment property. Having a depreciation schedule for your rental property offers several key benefits for property investors. First and foremost, it increases your tax deductions, which can significantly reduce your taxable income and result in substantial tax savings. This, in turn, enhances your cash flow by providing additional funds that can be reinvested in property maintenance, mortgage repayments, or further investments. A comprehensive depreciation schedule also enables future planning by providing a long-term projection of depreciation deductions and assisting in making informed decisions about your investment strategy. Additionally, engaging a qualified quantity surveyor to prepare the schedule ensures compliance with Australian Taxation Office guidelines and reduces the risk of audits or disputes with tax authorities. One of the main benefits of a depreciation schedule is the ability to increase your tax deductions. By accurately claiming depreciation expenses on your annual tax return, you can reduce your taxable income and potentially save thousands of dollars in taxes. Depreciation deductions are tax-deductible expenses that offset your rental income, resulting in lower taxable income and a reduced tax liability. The depreciation schedule allows you to claim deductions for both capital works and plant and equipment depreciation. These deductions are based on the decline in value of the assets over time due to wear and tear or obsolescence. By properly documenting and claiming these deductions, property investors can optimise their tax benefits and minimise their tax liability. Claiming depreciation deductions can have a significant impact on your taxable income and overall financial position. It is important to consult with a qualified tax professional or accountant to ensure that you are claiming all eligible deductions and maximising your tax benefits. A depreciation schedule can have a positive impact on the cash flow of property investors. By increasing tax deductions, property owners can reduce their taxable income and potentially inject more cash into their pockets. This additional cash can be reinvested in property maintenance, mortgage repayments, or further property investments. The tax savings from depreciation deductions can provide property investors with a financial boost and help them achieve their investment goals. By optimising their tax benefits through accurate depreciation claims, property owners can improve their overall cash flow and create a more sustainable and profitable investment portfolio. It is important for property investors to understand the cash flow benefits of a depreciation schedule and incorporate it into their financial planning. By maximising their tax deductions, property owners can enhance their returns and make the most of their investment properties. Creating a depreciation schedule for your rental property involves several key steps. The first step is to engage the services of a professional quantity surveyor who specializes in tax depreciation. The quantity surveyor will conduct a thorough property inspection to identify and document all depreciable assets within the property. Once the inspection is complete, the quantity surveyor will prepare a comprehensive depreciation schedule that outlines the various tax depreciation deductions available for your specific investment property. This schedule will include the depreciation rates, effective lives, and claim deductions for both capital works and plant and equipment assets. It is important to ensure that your depreciation schedule is prepared by a qualified quantity surveyor who is knowledgeable about the Australian Taxation Office guidelines and regulations. By working with a professional, you can be confident that your depreciation schedule is accurate, compliant, and optimised for maximum tax benefits. Professional quantity surveyors play a crucial role in the creation of a depreciation schedule for your rental property. These experts are qualified to estimate the construction costs of buildings, as well as the depreciation rates and effective lives of depreciable assets. When creating a depreciation schedule, a quantity surveyor will conduct a thorough property inspection to identify and document all depreciable assets within the property. This inspection ensures that all eligible assets are included in the schedule and that accurate depreciation deductions can be claimed. The expertise and knowledge of a qualified quantity surveyor are essential for creating a comprehensive and accurate depreciation schedule. By engaging a professional, property owners can be confident that their schedule meets Australian Taxation Office guidelines and provides the maximum tax benefits available. Acquiring a comprehensive depreciation schedule for your rental property involves several key steps. The first step is to gather all relevant property details, such as the purchase price, construction date, and any renovations or improvements made to the property. Next, you need to engage the services of a qualified quantity surveyor who specialises in tax depreciation. The quantity surveyor will conduct a property inspection to identify and document all depreciable assets within the property. Two of the larger companies are DuoTax and BMT Tax Depreciation. Once the inspection is complete, the quantity surveyor will prepare a detailed depreciation schedule that outlines the depreciation rates, effective lives, and claim deductions for all depreciable assets. This schedule can then be used to accurately claim depreciation expenses on your annual tax return. It is important to consider the fees associated with engaging a quantity surveyor to prepare the depreciation schedule. While there is an upfront cost, the long-term tax benefits and financial advantages of having a comprehensive depreciation schedule far outweigh the initial investment. Maximising your depreciation claims involves focusing on key areas and avoiding common mistakes. One important area to focus on is the prime cost and depreciation rate. Understanding the prime cost method and selecting the appropriate depreciation rate can result in higher deductions and greater tax benefits. Another key aspect is accurately documenting all depreciable assets within your property. This includes both the capital works and plant and equipment assets. By ensuring that all eligible assets are included in your depreciation schedule, you can maximise your deductions and optimise your overall tax benefits. On the other hand, it is important to avoid common mistakes in depreciation claims, such as overestimating the value of assets or claiming deductions for ineligible expenses. By consulting with a qualified professional quantity surveyor and following the guidelines set by the Australian Taxation Office, you can ensure that your depreciation claims are accurate and compliant. To maximise your depreciation deductions, it is important to focus on key areas such as the prime cost and depreciation rate. The prime cost method allows for an even allocation of the asset's cost over its effective life. By selecting the appropriate depreciation rate, you can ensure that you are claiming the maximum deductions for each asset. Additionally, identifying and documenting all depreciable assets within your property is crucial. This includes both the capital works and plant and equipment assets. By accurately including all eligible assets in your depreciation schedule, you can optimise your deductions and maximise your overall tax benefits. By focusing on these key areas and ensuring accurate documentation, property owners can make the most of their depreciation claims and enhance their overall financial position. When claiming depreciation deductions for your rental property, it is important to avoid common mistakes that can result in inaccuracies or potential issues with the tax authorities. One common mistake is overestimating the value of assets or claiming deductions for ineligible expenses. It is essential to accurately document the value of assets based on their actual purchase price or market value. Another mistake to avoid is failing to properly claim depreciation expenses on your annual tax return. By ensuring that you include all eligible deductions and accurately calculate the depreciation expenses, you can optimise your tax benefits and avoid potential audits or disputes with the tax authorities. Overall, it is important to consult with a qualified tax professional or accountant to ensure that your depreciation claims are accurate, compliant, and optimised for maximum tax savings. Real-life case studies can provide practical examples of how depreciation schedules can benefit both residential and commercial properties. These examples demonstrate the potential tax savings and financial advantages that can be achieved through accurate depreciation claims. In a residential property case study, the depreciation schedule outlines the deductions available for the building structure and the plant and equipment assets. The case study highlights the potential tax savings and the projected depreciation deductions over the property's effective life. In a commercial property case study, the depreciation schedule focuses on the deductions for the building structure and the specific assets relevant to commercial properties. The case study showcases the significant tax savings and the long-term financial benefits that can be achieved through accurate depreciation claims. These real-life examples illustrate the importance of having a depreciation schedule and the tangible advantages it offers to property investors. In a residential property case study, let's consider an owner of a residential investment property who purchased the property for $500,000. The depreciation schedule prepared by a qualified quantity surveyor determines that the building structure has a depreciable value of $400,000, while the plant and equipment assets within the property have a depreciable value of $50,000. Using the prime cost method and an effective life of 40 years for the building structure, the owner may be eligible to claim an annual depreciation deduction of $10,000 ($400,000 divided by 40 years). For the plant and equipment assets with an effective life of 10 years, an annual depreciation deduction of $5,000 ($50,000 divided by 10 years) can be claimed. By accurately claiming these depreciation deductions on their annual tax return, the owner can reduce their taxable income by $15,000, potentially resulting in significant tax savings depending on their tax rate. This case study demonstrates the financial benefits of having a depreciation schedule for residential investment properties. In a commercial property case study, let's consider an owner of a commercial office building purchased for $2 million. The depreciation schedule prepared by a qualified quantity surveyor determines that the building structure has a depreciable value of $1.5 million, while the plant and equipment assets have a depreciable value of $200,000. Using the prime cost method and an effective life of 40 years for the building structure, the owner may be eligible to claim an annual depreciation deduction of $37,500 ($1.5 million divided by 40 years). For the plant and equipment assets with an effective life of 15 years, an annual depreciation deduction of $13,333 ($200,000 divided by 15 years) can be claimed. By incorporating these depreciation deductions into their annual tax return, the owner can potentially reduce their taxable income by $50,833. The actual tax savings will depend on their specific tax rate and circumstances. This case study highlights the significant tax benefits of having a depreciation schedule for commercial properties. Understanding legislative considerations and ensuring compliance with Australian Taxation Office (ATO) guidelines are crucial when it comes to depreciation schedules. Recent changes in tax laws can affect depreciation claims, and it is important to stay updated on these changes. Keeping track of the effective life and depreciation rates of assets is essential to ensure accurate calculations and claim substantiation. Compliance with ATO guidelines helps reduce the risk of audits or disputes with tax authorities. By staying informed and complying with relevant legislation, property owners can ensure that their depreciation schedules meet ATO requirements and provide accurate and compliant depreciation claims. To ensure that your depreciation schedule meets Australian Taxation Office (ATO) requirements, it is important to engage a qualified quantity surveyor who specialises in tax depreciation. A professional quantity surveyor will have the necessary expertise and knowledge to ensure compliance with ATO guidelines. The ATO has specific requirements for depreciation schedules, including accurate documentation of depreciable assets and adherence to the relevant legislation. By working with a qualified quantity surveyor, property owners can have confidence that their depreciation schedule meets these requirements and is compliant with ATO guidelines. Accurate calculations, proper documentation, and compliance with ATO guidelines are essential for maintaining a valid depreciation schedule. By ensuring compliance, property owners can confidently claim their depreciation deductions and enjoy the tax benefits of their investment property. Staying informed about these changes and complying with the updated tax laws will help property owners optimise their depreciation claims and maximise their overall tax benefits. In conclusion, understanding and implementing a depreciation schedule for your rental property is crucial for maximising tax advantages and enhancing cash flow. By focusing on capital works and plant and equipment deductions, you can optimise your claims and avoid common mistakes. Consider seeking assistance from professional quantity surveyors to create a comprehensive schedule that complies with legislative requirements. Stay updated on recent tax law changes to ensure continued compliance. Real-life case studies provide practical insights into the benefits of depreciation schedules. If you have any questions or need guidance on creating your own schedule, feel free to get in touch for expert advice. It is recommended to update your depreciation schedule each financial year to accurately claim depreciation deductions on your tax return. By updating your schedule annually, you can account for any changes in the property or asset values and make the most of available deductions. This ensures that your depreciation claims are accurate and compliant with the latest tax laws. Yes, you can back-claim depreciation if you haven't previously done so. If you have owned the property for several years and haven't claimed depreciation deductions, you can still acquire a depreciation schedule and back-claim the deductions for previous years. This can result in significant tax savings and potentially increase your tax refund for those years. Consult with a qualified tax professional or accountant to ensure that you correctly claim the back-dated depreciation deductions on your tax return. Division 40 refers to plant and equipment depreciation, which includes removable assets within a property. Division 43 refers to capital works depreciation, which includes the building structure and permanent fixtures. The depreciation rates and effective lives differ between the two divisions, and it is important to accurately categorise assets to claim the appropriate deductions. Yes, renovations on your rental property can be depreciable. Any capital improvements made to the property, such as structural changes or additions, can be claimed as capital works depreciation. It is important to accurately document and assess the costs of these renovations to claim the appropriate deductions. Consult with a qualified quantity surveyor or tax professional to ensure that you correctly claim depreciation for renovations on your rental property. Looking for help with your accounting, bookkeeping or taxes? Mahler Advisory can help! Click below to call or schedule a online appointment with us. *Please note that the above information is general advice only. We recommend you seek advice from a specialist relevant to your personal situation. This information is correct at the time of publishing and is subject to change*Depreciation Schedule for Rental Property: Essential Guide

Key Highlights

Introduction

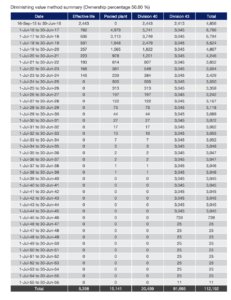

What does a depreciation schedule look like?

Introduction to Depreciation Schedules for Rental Property

Understanding the Basics of Depreciation

Importance of Depreciation Schedules in Real Estate Investment

Types of Depreciation Relevant to Rental Properties

Capital Works Deductions

Plant and Equipment Deductions

Benefits of Having a Depreciation Schedule

Tax Advantages and Deductions

Enhancing Cash Flow for Property Investors

Creating Your Depreciation Schedule

The Role of Professional Quantity Surveyors

Steps to Acquire a Comprehensive Depreciation Schedule

Maximising Your Depreciation Claims

Key Areas to Focus on for Optimal Deductions

Common Mistakes to Avoid in Depreciation Claims

Case Studies: Real-Life Depreciation Schedule Examples

Residential Property Case Study

Commercial Property Case Study

Legislative Considerations and Compliance

Ensuring Your Schedule Meets ATO Requirements

Conclusion

Frequently Asked Questions

How Often Should I Update My Depreciation Schedule?

Can I Back-Claim Depreciation if I Haven’t Before?

What’s the Difference Between Division 40 and 43?

Are Renovations on My Rental Property Depreciable?