Simon Madziar

Simon Madziar

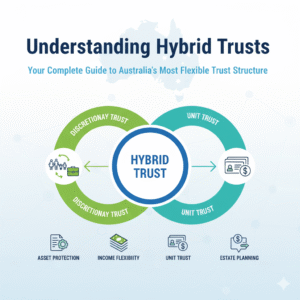

Hybrid trusts are rapidly becoming the preferred choice for savvy Australian investors and business owners who need both certainty and flexibility in their financial structures. Unlike traditional trust arrangements that force you to choose between fixed entitlements or discretionary distributions, hybrid trusts offer the best of both worlds. If you're considering establishing a trust for your business, investment portfolio, or family wealth planning, understanding how hybrid trusts work could unlock significant tax advantages and asset protection benefits. This comprehensive guide will walk you through everything you need to know about hybrid trusts in Australia, helping you determine whether this sophisticated structure aligns with your financial objectives. We'll explore the mechanics of hybrid trusts, examine their tax implications, and provide practical insights into when they might be the right choice for your circumstances. By the end of this guide, you'll have a clear understanding of whether a hybrid trust could be the key to achieving your wealth-building and protection goals. A hybrid trust combines the structural benefits of both unit trusts and discretionary trusts into a single, flexible arrangement. This dual nature is what gives hybrid trusts their unique appeal among Australian investors and business owners. In a unit trust, beneficiaries hold specific units that give them fixed entitlements to both income and capital. While this provides certainty, it lacks the flexibility to adapt to changing tax circumstances or family situations. Conversely, discretionary trusts give trustees complete control over distributions, offering maximum flexibility but no guaranteed entitlements for beneficiaries. Hybrid trusts bridge this gap by dividing the trust's assets into units (like a unit trust) while allowing the trustee discretionary power over income distributions (like a discretionary trust). This means unit holders have fixed rights to the trust's capital, but the trustee can strategically distribute income based on beneficiaries' changing tax positions and circumstances. The hybrid trust deed governs these arrangements, clearly defining how units are allocated and how discretionary powers can be exercised. This document becomes the roadmap for balancing certainty with flexibility throughout the trust's operation. The unit structure in hybrid trusts provides certainty around capital ownership. When you hold units in a hybrid trust, you have a fixed entitlement to your proportionate share of the trust's capital. This feature is particularly valuable for business partnerships or joint ventures where parties want clear ownership rights. For example, if two business partners establish a hybrid trust with 100 units each, they both have certain rights to 50% of the trust's capital, regardless of how income distributions are made throughout the year. Despite fixed capital entitlements, hybrid trusts allow trustees to distribute income flexibly among beneficiaries. This discretionary power enables strategic tax planning, as trustees can direct income to beneficiaries in lower tax brackets or those with available tax losses. The flexibility extends to timing as well. Trustees can choose whether to distribute income in a particular year or accumulate it within the trust, depending on beneficiaries' circumstances and overall tax strategy. Hybrid trusts can stream different types of income to different beneficiaries. For instance, capital gains might be directed to one beneficiary while rental income flows to another, allowing for sophisticated tax optimisation strategies that wouldn't be possible with simpler trust structures. The combination of fixed capital rights and flexible income distribution creates powerful tax planning opportunities. Trustees can assess beneficiaries' tax positions each year and distribute income accordingly, potentially saving thousands in tax across the family group or business partnership. This flexibility becomes particularly valuable when beneficiaries have varying income levels, available tax losses, or different marginal tax rates. The trustee can adapt the distribution strategy annually to optimise the overall tax position. Hybrid trusts provide robust asset protection by separating legal ownership (held by the trustee) from beneficial ownership (held by unit holders and beneficiaries). This separation can protect trust assets from creditors of individual beneficiaries, as the assets technically belong to the trust, not the beneficiaries personally. The discretionary element adds another layer of protection, as potential creditors cannot predict or rely on specific income distributions to individual beneficiaries. When hybrid trusts hold assets for more than 12 months, they can access the 50% capital gains tax discount. This benefit can be passed through to individual beneficiaries, potentially halving the tax payable on long-term capital gains. For property investors and business owners planning to hold appreciating assets long-term, this discount can result in substantial tax savings when assets are eventually sold. The unit structure in hybrid trusts facilitates smooth succession planning. Units can be gifted or sold to the next generation over time, gradually transferring ownership while maintaining family control over the trust's operations. This gradual transfer approach can help minimise stamp duty and capital gains tax implications compared to direct asset transfers, making it an efficient wealth transfer mechanism. Income distributed from a hybrid trust to beneficiaries is generally taxed in the hands of those beneficiaries at their marginal tax rates. This creates opportunities to direct income to family members in lower tax brackets, potentially reducing the overall tax burden. However, trustees must be mindful of anti-avoidance provisions that may apply if distributions are made primarily for tax reasons rather than genuine commercial or family purposes. Any income not distributed to beneficiaries by 30 June is taxed within the trust at the highest marginal tax rate (currently 45% plus Medicare levy). This penalty rate encourages trustees to make distribution decisions before year-end, but it also provides flexibility to accumulate income when beneficial. Franking credits from Australian company dividends flow through to beneficiaries along with the income distribution. This can provide valuable tax offsets, particularly for beneficiaries with lower incomes who might receive refunds of excess franking credits. The 50% capital gains tax discount applies to capital gains made by the trust on assets held for more than 12 months. When these gains are distributed to individual beneficiaries, they can also claim the discount, effectively halving the tax payable on long-term capital gains. To compare hybrid trusts with other types of trusts, here’s a handy table: This table shows how hybrid trusts are unique in offering both flexibility and fixed entitlements. Hybrid trusts excel in situations involving unrelated business partners who want certainty around capital ownership but flexibility in profit sharing. The unit structure provides clear ownership rights, while discretionary distributions allow for varying profit allocations based on contribution, tax positions, or agreed arrangements. Consider a property development project where partners contribute different amounts of capital and expertise. A hybrid trust can provide fixed capital entitlements reflecting initial contributions while allowing flexible profit distributions based on ongoing involvement or tax circumstances. Families with significant investment portfolios often benefit from hybrid trusts' ability to provide both stability and adaptability. Parents might hold the majority of units, ensuring control over capital decisions, while income distributions can flow to various family members based on their tax positions and financial needs. This structure proves particularly valuable for families with children at different life stages, where income needs and tax circumstances vary significantly across family members. Property investors frequently choose hybrid trusts for their portfolios because they combine long-term capital growth potential with flexible income management. The structure allows for strategic distribution of rental income and capital gains while providing strong asset protection. The ability to stream different types of income to different beneficiaries means rental income might flow to one family member while capital gains go to another, optimising tax outcomes across the family group. Medical practitioners, lawyers, and other professionals often use hybrid trusts to hold practice-related investments or properties. The structure provides asset protection from professional indemnity claims while allowing flexible income distributions to family members. Establishing a hybrid trust requires expertise in trust law, taxation, and ongoing compliance. Your advisory team should include a lawyer specialising in trust structures and an accountant with experience in trust taxation and administration. The complexity of hybrid trusts makes professional guidance essential, not optional. Attempting to establish these structures without proper expertise often leads to compliance issues and missed opportunities for optimisation. The trust deed is the foundation document that governs your hybrid trust's operation. This document must be carefully crafted to reflect your specific objectives while ensuring compliance with legal and taxation requirements. Key elements include defining unit classes, distribution powers, trustee duties, and beneficiary rights. The deed should also include provisions for unit transfers, trust termination, and dispute resolution procedures. Choosing between an individual or corporate trustee significantly impacts your trust's operation and liability exposure. Individual trustees face unlimited personal liability for trust debts, while corporate trustees limit liability to the company's assets. Many advisers recommend corporate trustees for hybrid trusts due to their enhanced asset protection, continuity benefits, and professional appearance in business dealings. The trust is settled by transferring a nominal amount (typically $10) from the settlor to the trustee. This simple transaction formally establishes the trust and enables the trustee to begin operating according to the trust deed. Following settlement, the trust must obtain a Tax File Number from the Australian Taxation Office and establish separate banking facilities for trust transactions. The final step involves issuing units to initial unit holders according to the agreed ownership structure. This process establishes each party's capital entitlements and voting rights within the trust framework. Proper documentation of unit holdings is crucial for ongoing administration and future unit transfers or additional issues. Trustees must make distribution decisions by 30 June each year, documenting these decisions in trustee minutes. These decisions should consider beneficiaries' tax positions, available losses, and overall family or business objectives. The discretionary nature of distributions requires trustees to actively consider beneficiaries' circumstances rather than simply following predetermined formulas. Hybrid trusts require meticulous record keeping to satisfy ATO requirements and support distribution decisions. This includes maintaining unit registers, trustee meeting minutes, distribution records, and beneficiary tax statements. Poor record keeping can jeopardise the trust's tax benefits and create compliance issues during ATO reviews. Trust tax returns must be lodged annually, reporting income, distributions, and maintaining appropriate records for beneficiary taxation. The complexity of hybrid trust taxation often requires professional preparation to ensure accuracy and optimisation. Beneficiaries also receive distribution statements for inclusion in their personal tax returns, creating a web of interconnected tax obligations that require careful coordination. Regular reviews with your advisory team help ensure your hybrid trust continues to meet objectives and remains compliant with evolving legislation. Tax laws and regulations change frequently, potentially affecting optimal trust operation. Annual reviews should assess distribution strategies, trustee performance, and whether the trust structure still aligns with your objectives. Hybrid trusts are more complex than standard discretionary trusts, requiring higher establishment costs and ongoing professional fees. This complexity can make them unsuitable for smaller arrangements where costs outweigh benefits. The need for ongoing professional advice throughout the trust's life should be factored into long-term cost considerations when evaluating whether a hybrid trust is appropriate. The Australian Taxation Office monitors hybrid trusts closely, particularly those used for property investment or family tax planning. Ensuring distributions are made for genuine commercial or family reasons, not purely tax minimisation, is crucial for avoiding ATO challenges. Recent ATO guidance has emphasised the importance of proper documentation supporting distribution decisions and genuine consideration of beneficiary circumstances. The combination of fixed capital entitlements and discretionary income distributions can create tension among beneficiaries, particularly in family situations. Clear communication and documented distribution policies help minimise conflicts. Consider including dispute resolution mechanisms in the trust deed to address potential conflicts before they escalate to legal proceedings. Trust taxation remains an area of ongoing legislative attention, with potential changes that could affect hybrid trust benefits. Staying informed about proposed changes and having flexibility to adapt is essential for long-term success. Your professional advisers should monitor legislative developments and recommend structural adjustments when necessary to maintain optimal outcomes. Understanding hybrid trusts represents just the beginning of your journey toward sophisticated wealth management and tax optimisation. These structures offer unparalleled flexibility for Australian investors and business owners who need both certainty and adaptability in their financial arrangements. The combination of fixed capital entitlements and flexible income distributions creates opportunities that simply aren't available through traditional trust structures. Whether you're building a property portfolio, establishing a business partnership, or planning intergenerational wealth transfer, hybrid trusts provide a framework that can adapt to your changing circumstances. However, the complexity of hybrid trusts means success depends heavily on proper establishment, ongoing professional management, and regular review of your structure's performance. The initial investment in professional advice pays dividends through optimised tax outcomes, enhanced asset protection, and strategic flexibility that simpler structures cannot provide. As you consider whether a hybrid trust aligns with your objectives, remember that these structures work best when they're part of a comprehensive wealth management strategy. The peace of mind that comes from knowing your assets are protected and your tax position is optimised makes the investment in proper professional advice worthwhile. Ready to explore whether a hybrid trust could benefit your situation? Our experienced team specialises in establishing and managing sophisticated trust structures for Australian investors and business owners. Book a free consultation today to discuss your specific circumstances and discover how a hybrid trust might unlock new opportunities for your financial future. The information provided in this blog is of a general nature and does not constitute financial, tax, or legal advice. Every financial situation is unique, and individuals should seek tailored advice from a qualified professional before making decisions about trust structures or other financial matters. While every effort has been made to ensure the accuracy of the information, we do not accept any liability for errors or omissions. Laws and regulations are subject to change, and it is important to stay informed and consult with a professional to ensure compliance with the latest requirements.Understanding Hybrid Trusts: Your Complete Guide to Australia's Most Flexible Trust Structure

What Makes Hybrid Trusts Different from Other Trust Structures

Key Features That Set Hybrid Trusts Apart

Fixed Capital Entitlements Through Unit Holdings

Flexible Income Distribution Powers

Streaming of Different Types of Income

Advantages That Make Hybrid Trusts Attractive

Strategic Tax Planning Opportunities

Enhanced Asset Protection

Capital Gains Tax Benefits

Succession Planning Advantages

Tax Implications You Need to Understand

Income Distribution Tax Treatment

Trust Tax Rates on Undistributed Income

Franking Credits and Tax Offsets

CGT Discount Eligibility

Hybrid Trusts vs Discretionary Trust Structures

Feature Hybrid Trust Discretionary Trust Unit Trust

Definition Mix of fixed and discretionary elements. Trustee has full discretion over distributions. Beneficiaries hold fixed units representing ownership.

Beneficiaries Some have fixed entitlements; others are discretionary. No fixed entitlements; all distributions are at trustee’s discretion. Unit holders have fixed entitlements to income and capital.

Control Shared between unit holders and trustee. Controlled solely by trustee. Controlled by unit holders (often via trustee).

Tax Planning Flexibility Moderate – some flexibility with discretionary components. High – allows strategic income distribution. Limited – income must be distributed according to unit holdings.

Asset Protection Good, but less than discretionary trusts. Strong – beneficiaries have no claim until distribution. Weaker – fixed entitlements can be exposed to creditors.

Estate Planning Can be complex due to fixed interests. Easier to manage via trustee discretion. Complex – units may be treated as assets in estate.

Land Tax Treatment (QLD) May be treated as a fixed trust (lower threshold), depending on structure. Treated as a trust – lower land tax threshold ($350,000). Treated as a fixed trust – may qualify for individual threshold ($600,000).

Complexity & Setup Cost Higher – requires careful drafting and legal advice. Lower – simpler structure and documentation. Moderate – requires unit register and formal agreements.

Suitability Suitable for joint ventures or mixed investment/family structures. Ideal for family groups seeking tax flexibility and asset protection. Suitable for investment syndicates or business partners.

When Hybrid Trusts Make Strategic Sense

Business Partnerships and Joint Ventures

Multi-Generational Family Investment Structures

Property Investment Portfolios

Professional Practice Structures

Setting Up Your Hybrid Trust: A Step-by-Step Process

Professional Advisory Team Assembly

Trust Deed Drafting and Customisation

Trustee Selection and Structure

Trust Settlement and Registration

Initial Unit Issue and Allocation

Management and Ongoing Compliance Requirements

Annual Distribution Decisions

Record Keeping and Documentation

Annual Tax Returns and Reporting

Ongoing Professional Reviews

Potential Risks and Challenges to Consider

Increased Complexity and Costs

ATO Scrutiny and Compliance Risks

Potential for Beneficiary Disputes

Regulatory and Legislative Changes

Maximising Your Hybrid Trust's Potential

Disclaimer