Simon Madziar

Simon Madziar

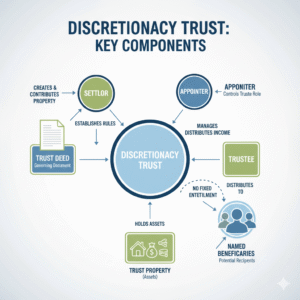

Managing wealth and planning for your family's future involves navigating a complex landscape of legal and financial structures. One of the most powerful and flexible tools available in Australia is the discretionary trust, often referred to as a family trust. If you're seeking to protect your assets, optimise your tax position, and ensure your wealth is managed according to your wishes, understanding how a discretionary trust works is essential. This guide provides a comprehensive overview of discretionary trusts, explaining what they are, how they function, and the significant benefits they can offer. We'll walk you through the key features, the setup process, and common pitfalls to avoid. By the end of this post, you'll have a clear understanding of whether this structure is the right fit for your financial goals and family's needs, giving you the confidence to take the next steps in securing your legacy. A discretionary trust is a legal arrangement where a person or a company (the trustee) holds assets on behalf of a group of people (the beneficiaries). The defining feature is the trustee's "discretion" to decide which beneficiaries receive income or capital from the trust, and how much they receive. Unlike other types of trusts where beneficiaries have a fixed entitlement, in a discretionary trust, no single beneficiary has an absolute right to any portion of the trust's assets or income until the trustee decides to make a distribution to them. This flexibility is the cornerstone of its utility in wealth management and estate planning. Understanding the components of a discretionary trust is the first step to appreciating its power. Every trust has several key roles and elements: For high-net-worth individuals and families, discretionary trusts offer a unique combination of advantages that are hard to replicate with other structures. One of the primary reasons for establishing a discretionary trust is asset protection. Since the assets are legally owned by the trustee and no single beneficiary has a fixed claim on them, they are generally shielded from creditors or legal claims against an individual beneficiary. For business owners or professionals in high-risk occupations, this separation can provide invaluable peace of mind, knowing that family assets are protected from business liabilities. Discretionary trusts are highly effective for tax planning. Each financial year, the trustee can decide how to distribute the trust's income among the beneficiaries. By distributing income to beneficiaries with lower marginal tax rates (such as adult children at university or a non-working spouse), the overall tax paid by the family unit can be significantly reduced. This flexibility allows you to adapt your tax strategy year after year as your family's circumstances change. A discretionary trust provides a structured and private way to manage and transfer wealth between generations. Unlike a will, which becomes a public document upon probate, a trust deed remains confidential. Assets held in a trust do not form part of a deceased individual's personal estate, so they are not subject to the potential challenges and delays of the probate process. The trust can continue to operate seamlessly after the death of the primary individuals, with control passing to the next generation according to the rules of the trust deed. Life is unpredictable. A discretionary trust's inherent flexibility allows it to adapt to changing family needs. For example, funds can be directed towards a child who needs support for education, a family member starting a business, or a beneficiary with special needs, all at the trustee's discretion. This adaptability ensures that your wealth can be used where it is most needed over the long term. Let's break down the annual lifecycle of a typical discretionary trust: Establishing a discretionary trust requires careful planning and professional advice. Here’s what’s involved: While powerful, discretionary trusts can be complex. Here are some common errors to avoid: It's helpful to understand how discretionary trusts differ from other common trust structures: A discretionary trust is a cornerstone of sophisticated wealth management in Australia, offering unparalleled benefits for asset protection, tax planning, and estate management. Its flexibility allows you to protect your family's wealth while adapting to their changing needs for generations to come. However, setting up and managing a discretionary trust is not a DIY task. It requires expert legal and financial advice to ensure the structure is established correctly and managed in a compliant manner. If you believe a discretionary trust could be the right solution for you, the next step is to speak with professionals who specialise in this area. Mahler Advisory can help you navigate the complexities, understand the implications for your specific situation, and provide the peace of mind that comes from knowing your family's future is secure. Contact us to schedule a free consultation and explore how a discretionary trust can benefit you and your family. Our team of experienced professionals is here to provide tailored advice and support every step of the way. Reach out now for personalised guidance and peace of mind. Disclaimer: This blog post provides general information only and does not constitute legal or financial advice. Consult with a qualified professional for personalised advice. Laws and regulations regarding trusts are subject to change. The information in this post is based on Australian law and may not be applicable in other jurisdictions. We are not liable for any actions taken based on the information provided in this blog post. Case studies and examples are for illustrative purposes only and do not guarantee specific outcomes.Discretionary Trusts Explained: Key Facts and Benefits

What is a Discretionary Trust?

Key Features of Discretionary Trusts

Benefits of Using a Discretionary Trust

Asset Protection

Tax Flexibility and Optimisation

Wealth Transfer and Estate Planning

Flexibility for Changing Family Circumstances

How a Discretionary Trust Works: A Step-by-Step Guide

Setting Up a Discretionary Trust: Legal and Tax Implications

Common Mistakes to Avoid

Discretionary Trusts vs. Other Types of Trusts

Your Next Steps